Everyone wants to be rich. Who doesn’t? Let’s face it; all of us need money to survive in this world. Having the capacity to buy your wants, apart from your needs, anytime and anywhere, is every person’s fantasy. We love to amass wealth and secure our financial future.

The problem is, not everyone knows how to do it! Most people struggle with keeping their finances intact. Did you know that 74% of all employees live paycheck to paycheck?

This is where budgeting plays a vital role. Learning how to manage your finances is as essential as working to earn money, after all!

Understanding Budgeting

Challenges of Budgeting

Importance of Budgeting

Budgeting Skills

Modern-day Budgeting

Benefits of Budgeting App

Today’s Best Budgeting Apps

* Mint

* YNAB

* PocketGuard

* Personal Capital

* Goodbudget

* Wally

* MoneyStrands

* Simple

* Mvelopes

* Wallet

Understanding Budgeting

Planning how to spend your hard-earned money is not as easy as spending it. There are bills to pay, mouths to feed, medicines to buy, and a whole lot more of financial obligations to fulfill. Anybody can quickly drown on the idea of having not enough money to make ends meet.

Luckily, learning how to budget is not rocket science. It is a skill that can be grasped quickly if you are determined to learn. Besides, this is the most viable solution to your financial challenges and eventually achieve your dream of being wealthy.

Setting a budget is the start of managing your income. It may seem like it’s preventing you from buying things, but there’s more to it than just a restriction. Others are discouraged because they think there’s not enough money to budget.

Budgeting is making sure that you live within your financial capacity. You’re not overspending your money. Budgeting is not only essential to individuals; it’s also vital to entrepreneurs.

Challenges of Budgeting

Generally, people aren’t too happy to heed sound financial advice. It often starts with tracking every dollar you’ve spent for that last month or so. This entails gathering all the receipts and tracking payments done for a specified period. Indeed, it’s tedious and time-consuming. Nowadays, anything that involves spending money is mostly done online. It can be easy-peasy for those who are tech-savvy, but it’s difficult for technophobes.

Despite the invasion of technology, there are still individuals who prefer to use cash. Cashless payment doesn’t seem to work for them. Usually, it’s the older generations that are adamant about paying in cash since this is a lot easier and faster for them. Who likes change anyway? The thing with using cash is, you have to keep the receipts just to monitor your spending. And you don’t have the chance to gather all these small pieces of paper all the time, especially if it’s worth a small amount. Manual tracking of your finances can result in inaccurate figures. Challenges are inevitable, mainly if it’s not within your norms. Understanding the importance of budgeting and familiarizing the process outweighs all these hurdles once you reap its benefits in the long run.

Importance of Budgeting

Financial management begins with budgeting. This is a tool to keep track of the movement of your finances. It gives you a clear view of the ins and outs of your money. The end goal here is to maximize and increase your spending power. Determining all the financial factors involved, such as how much money is in your bank account, allocations, and setting target savings, is part of the process.

When the initial budget has been determined, you can begin to look into tracking your funds. If you’re looking at a long term plan, you can set a budget for the next two quarters, up to an entire year or even until your retirement. This allows you to foresee which months can be strained or which will give you extra savings. Budgeting paints a clearer picture of your current financial trend and your future. Make use of this so your finances will be more controllable and organized.

Forecasting your budget will also confirm if you are financially capable of investing or engaging in other money-related obligations. Going on a leisure trip with your loved ones, purchasing a new car, and refurbishing your home are some of the expenditures which can come along the way. These are not urgent, but they can be valuable in the long run. Budgeting will iron out all these activities for you. Knowing how much savings you have and how much you need to set aside are components of financial management.

Moreover, emergencies can significantly affect your finances. This is when people run into difficulties when there are unforeseen events such as illness, accidents, tragedies, and other mishaps occur. Nobody likes these things to happen, but these are life’s inevitable realities. When you have managed your funds responsibly, however, financial emergencies can easily be dealt with!

Budgeting Skills

If you can easily adjust and become proactive in organizing your finances, you are said to possess excellent budgeting skills. You read it right; budgeting is a skill. Budgeting requires you to make decisions regarding your money. Setting the right allocation for different expenses, without going beyond your income will be your primary responsibility. It sounds complicated, but once you are familiar with the process, everything will be smooth sailing.

Mastering your budgeting skills can bring you benefits, not just in your personal life but in your business as well. This is a must for every entrepreneur. Any business entity can’t move forward with its operation if no one from the company has impressive budgeting skills. Running an enterprise is just like going through life, there are different aspects to consider, and all of these require cash flow. Lack of knowledge of financial management can lead the business into bankruptcy.

Modern-day Budgeting

Technology has made life simpler. Tracking your finances is readily available through your cell phone. Any mobile device can help individuals go through their monetary expenditures. With the vigorous promotion of cashless shopping, the majority are using mobile wallets as their payment mode. It’s quick, easy, and environmentally-friendly. Banks have been intensely promoting internet banking for more convenience on both parties. Everyone can have access to their bank accounts whenever, wherever. This also suggests that anyone can monitor if they’ve overspent their money or if they still have enough cash to last for the day.

A survey was conducted on mobile users who are avid fans of cashless spending. Of the 3,600 smartphone users asked, some 18% used budgeting apps. Out of this number, 69% said budgeting apps changed their approach to spending their money. It made their financial activities more manageable since they can easily keep an eye on what comes in or out from their savings account.

With the rapid surge of mobile applications, IT companies who specialize in creating budgeting apps continue to make more budgeting tools. Once active users have successfully downloaded the application, they get hooked navigating the functions. After a while, they’re drawn to setting their budget targets since tracking their achievements comes in handy. Nothing beats the hassle-free system of pulling up your spending data, with just one click.

There have been several budgeting tools designed to suit every smartphone user’s needs. In the past, budgeting is as tedious as writing a dissertation, gathering all data needed, manually. So much time wasted on data collection because almost everything is only available offline. Nowadays, simply pick the appropriate budgeting platform, and it will change your life.

In the survey conducted among smartphone owners, the data showed 60% of these active users fall between the age bracket of 25-35 year-olds. Although these apps are usually made easy to navigate for any user. According to the respondents, they are encouraged to budget their money because the app automatically records their spending. Aside from that, their bank accounts are also linked, which will then show all their cash flow activities. Hence, they become more responsible spenders.

Benefits of Budgeting App

As mentioned earlier, people find it challenging to budget their finances. Through a variety of budgeting apps, this changed their perspective. However, there are still others who are doubtful of the benefits of using them. They haven’t figured out the fact that these money management apps have features that can streamline your elaborate financial activities.

Let’s face it, weaving through your daily expenses is exhausting. But there is just no other way to do it; you have to sift through everything. Every expenditure should be categorized down to the cheapest amount spent. See how boring it could get? That’s the beauty of technology. Through budgeting apps, you can take note of these critical details. From there, you can grasp your current financial standing and how to go from there.

For individuals who have more stable earnings, this means they also have healthier money-related transactions. They can afford to invest and engage in serious financial obligations. Although not everyone will opt to hire an accountant just to sort everything out. Others will do it themselves with the help of budgeting platforms. With ample knowledge of technology, they would instead use software applications to account for their finances. Indeed, the benefits of using budgeting tools are boundless.

Today’s Best Budgeting Apps

After understanding the importance of setting a budget and learning the efficacy of budgeting apps, it’s time to consider your options. What is the right budgeting app for you? Every application has its pros and cons. It’s just a matter of filtering it according to your needs and ability to navigate it. Everyone has their way of overseeing their funds.

Let’s take a look at these ten best budgeting apps, which will help you reach your financial goals and dreams.

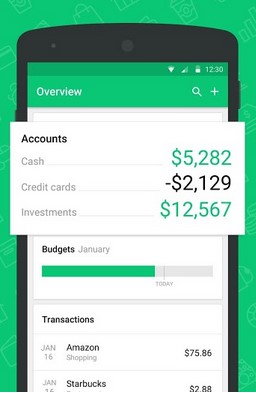

Mint

Mint has been available for almost a decade now. This is one of the popular budgeting apps, especially for beginner budgeters. This collates all financial data into a single section. Banks, credit cards, and other money-related accounts can all be accessed through the dashboard. It’ll help categorize transactions such as ATM withdrawals, purchases, and bill payments. From there, a tentative budget is created based on the spending pattern of the user. Take, for example, the amount used on groceries, dining out, shopping, and other personal necessities, the average you’ve spent will be calculated automatically. That amount will be the basis for the planned budget in the coming months. You can easily customize the budgets accordingly so that it will be tailored to your needs.

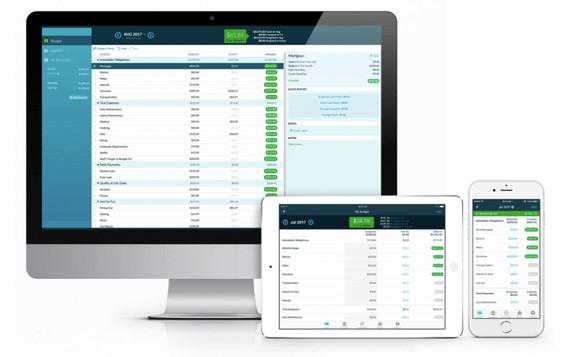

YNAB

Most budgeting apps will ask you to link bank accounts to note the turnover of the funds. Apart from that, You Need a Budget, or commonly known as YNAB, also has a function of manually recording the movement. If you are opting for a do-it-yourself service, you don’t have to link any of your savings accounts. Some users are hesitant to let third-party applications log their finances for security reasons. Credit card accounts can as well be synced to YNAB. It will set a specific allocation for your credit card dues and also arrange to settle your balances. This app focuses mainly on your liquidity, and the budget stems from the actual amount of money you have. Hence, the forecasts are more realistic.

PocketGuard

When you’re looking for a more straightforward approach to budgeting, PocketGuard is an excellent option to consider. Unlike other apps, it is free for use. It has a direct method of showing you how much money is left for spending. A daily, weekly, and monthly monitoring of your cash-related activities are made available for tracking purposes. Of course, linking your bank accounts is a must once you have set up your primary details. Another notable feature of this budgeting tool is that it shows you several options to save your money. When you see these opportunities, it gives you the motivation to adjust your spending habits to a minimum.

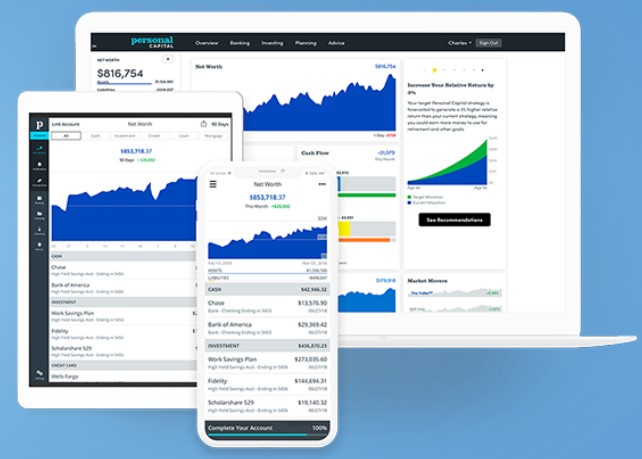

Personal Capital

If you are aiming for long-term financial management, Personal Capital is something you can take a look into. This is geared towards monitoring your investments and retirement plan. Even if retiring is a slightly farfetched topic at the moment, you will have to deal with it at some point. This app gets information and lets you see how your long-term financial goals will possibly play out.

To use this app, input your age, planned retirement year, savings, and investment ventures.

From there, the software will provide you a peek at your future financial status. The basics of budgeting, such as your expenditure tracking, bank account movement, and cash flow are also taken into account. If you’re thorough about handling your finances, Personal Capital is for you.

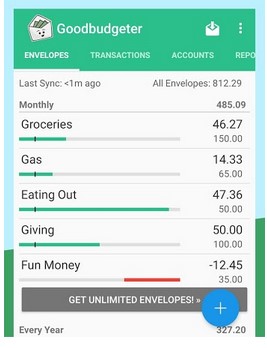

Goodbudget

Most people are fond of envelope methods when they do their budgeting. If you’re one of them, it’s time to update your system and try using Goodbudget. This is a whole lot easier compared to doing it manually. It will help you sort out your money in portions based on your expenses. Interestingly, it’s almost like setting your funds aside for a specific expenditure by placing your money in an envelope. You should encode the figures and disclose your outstanding payables and receivables, but there is no need to link any bank accounts. With Goodbudget, you don’t have to worry about putting everything in sync. It’s a no-sweat budget tracker that will keep you in line with your financial goal.

Wally

Beginning budgeters prefer the least complicated as possible method. The appropriate budgeting app for these people is Wally. It doesn’t take a genius to uncover how this software works. An expenditure tracker that will organize your savings, income, and payables on a daily, weekly, or monthly basis. Reminders for upcoming dues for credit cards and financial liabilities are included in the features, you simply have to set it up after you signed in. All data is shown in a calendar-style presentation for easier interpretation. This is a hassle-free budgeting tool with simple use.

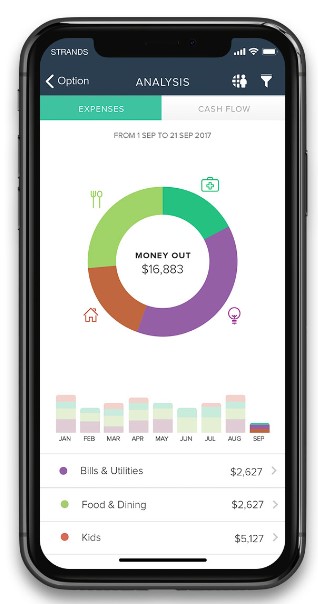

MoneyStrands

Make budgeting more fun and exciting with MoneyStrands. This budgeting app is packed with visual effects such as charts and graphs to review your money-related activities. Nothing is duller than looking into your income and expenses. To spice it up, MoneyStrands arranges your costs accordingly and plots it into a calendar-type format. In this manner, you can identify when you have spent the most and your upcoming receivables. Linking of bank and credit card accounts is also an added feature, so nothing is left unattended. Keep your financial management interesting with colorful visuals, give MoneyStrands a try.

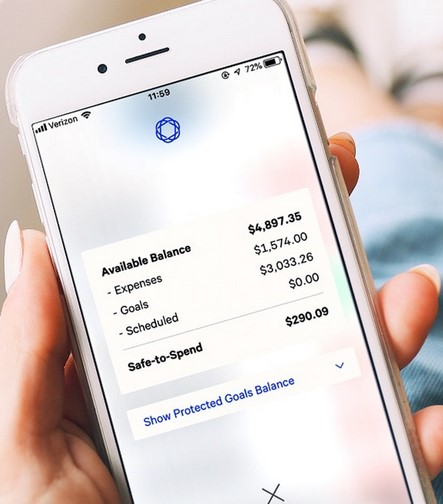

Simple

When you are loaded, so are your bank accounts. Simple organizes these accounts together with your budget. It is a budgeting app that deals mainly with your money in the bank. Your previous checking accounts will be swapped with your primary bank account. Similar to other budgeting tools, there are features of tracking your expenses and other budgeting basics. You can still be in control of your finances. A pivotal function to note is the Safe-to-Spend wherein it’s a reminder that you’re within your budget or you have gone beyond the limit. When it comes to budgeting, always stay in line.

Mvelopes

Another budgeting app that stemmed from the envelope method is Mvelopes. It requires you to categorize your expenses and then set aside funds for each category. An excellent way of sorting out your money and putting it in every envelope that has your unpaid dues. This app will also allow you to connect all your bank and credit card accounts for effortless cash monitoring. You’ll be impressed with its actual-time budget tracking because it tells you if you can afford to buy a new dress or wait for the next pay. Now, that’s how we stay on budget!

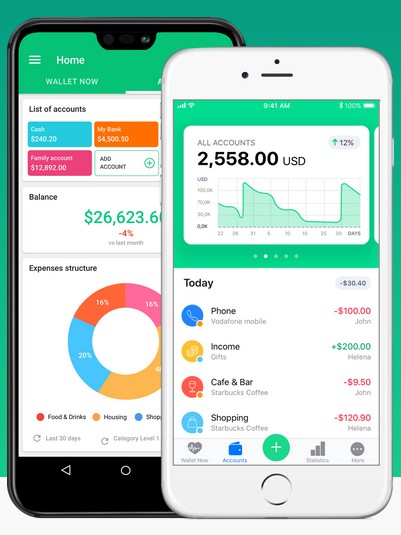

Wallet

Keep your finances neat and tidy with the Wallet app. A budgeting tool that gives you a snapshot of your financial activities. Budget tracking through synching your bank, credit card accounts, and payables are all available to the users. But you can also input the data manually if you prefer to do it that way. The Wallet app will show your financial transactions in logical visuals, so it’s easy to track and analyze.