Retirement is the most common, and most important, savings goal. Almost everyone wants to be able to stop working at some point. Most people say they plan to travel and spend time with loved ones during retirement, and save with this happy goal in mind. But the reality is that many people have to retire earlier than they planned, because of health or employment issues. Others are unable to stick to their planned timeline because they haven’t yet saved enough. And as life expectancy steadily increases, many people find they need to stretch their retirement savings much further than they’d anticipated.

With so many variables at play, creating a savvy and flexible plan for retirement is key. Actively saving during your working years is challenging but essential, and investing your savings in the right retirement plan can make your money work that much harder towards this important goal. A more lucrative, more secure, or tax-advantageous retirement plan can make the difference between retiring on-time and living comfortably at age 62 or retiring late and living modestly at age 82.

There are a huge number of retirement plans available today that address different goals. The wealth of options means that there’s a retirement plan for every budget, career path, and savings goal, but that finding the right one can be difficult. Many people come by their retirement plan through their employer as part of their employee benefits. If you’re job seeking, understanding the retirement policy being offered is critical to knowing how good your prospective benefits package is.

Retirement plans fall into two broad categories: Qualified Retirement Plans and Non-Qualified Retirement Plans. Here, we’ll walk you through the definition and common examples of each. We’ll also discuss how qualified and non-qualified retirement plans are different, and how each can work to help you reach your retirement savings goals.

Jump To:

- What is a Retirement Plan?

- What is a Qualified Retirement Plan?

- What is a Non-Qualified Retirement Plan?

- How are Qualified and Non-Qualified Retirement Plans Different?

- Which is Better: Qualified or Non-qualified Retirement Plans?

What is a Retirement Plan?

If you plan to stop working at a certain age, or step back your level of work, you’ll still need to meet expenses. Depending on your lifestyle, this may mean little beyond room and board. More likely, you’ll want to enjoy extras like dining out, traveling, and hobbies during your years of leisure. A retirement plan is a financial strategy for sustaining yourself during retirement, and includes saving, investing, and, eventually, distributing assets.

Retirement plans can be established by employers, trade unions, insurance companies, the government, or by other organizations. Because the government wants people to be self-sufficient sun retirement, a variety of different retirement plans are given favorable tax treatment.

Along with perks like paid time off and health insurance, qualified and non-qualified retirement plans are one of the benefits that employers set up and make available for the benefit of their employees in order to attract and retain the best staff.

What is a Qualified Retirement Plan?

A qualified retirement plan follows the guidelines of the Department of Labor’s Employee Retirement Income Security Act (ERISA) and meets the requirements of the IRS’ Internal Revenue Code Section 401(a). Any plans that are covered by this section are eligible for certain tax benefits.

The employer offering the qualified retirement plan may be responsible for different levels of contribution based on the type of plan, and handles the investment of funds. Qualified retirement plans typically involve investments in mutual funds, real estate, money market funds, and stocks, or a blend of these.Common types of qualified retirement plans include:

- 401(k) plans

- 403(b) plans

- Profit-sharing plans

- Money purchase plans

- pensions

- Simplified Employee Pension (SEP)

- Salary Reduction Simplified Employee Pension (SARSEP)

- Savings Incentive Match Plan for Employees (SIMPLE)

- Employee stock ownership (ESOP) plans

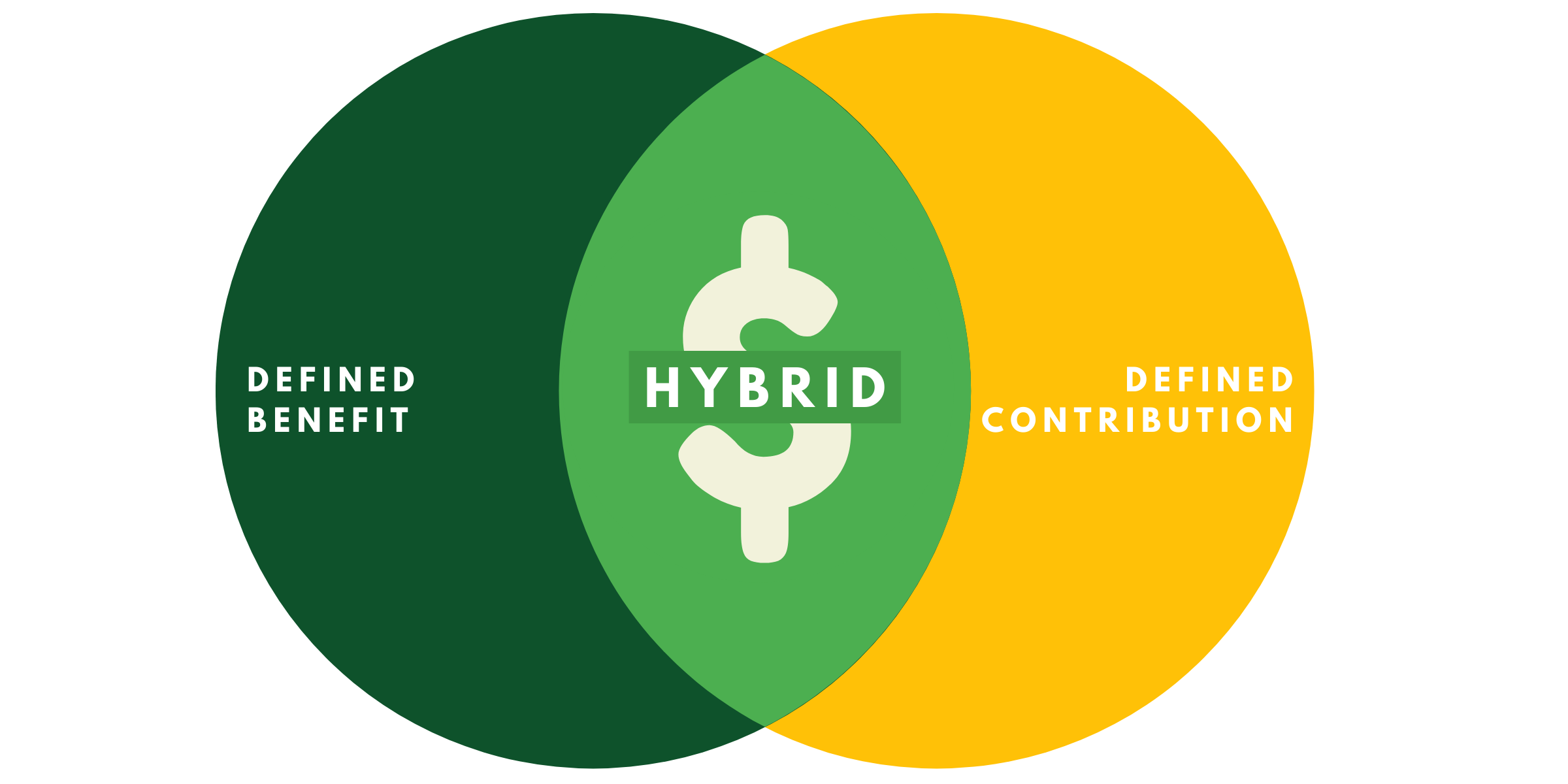

These different types of qualified retirement plans can be broadly grouped into three categories: defined benefit plans, defined contribution plans, and hybrid contribution plans.

Defined benefit plans: also called pension plans, a defined benefit plan is an employer-sponsored retirement plan in which income during retirement is guaranteed by an employer. Employees bear no risk in a defined benefit plan; they receive a certain allotted amount starting on a certain date. A defined benefit plan is usually guaranteed to pay out for life, and increases a bit over time to account for the rising cost of living. Defined benefit plans offer enrollees simplicity and security in their retirement planning, and don’t require them to take any investment steps.

Defined contribution: a defined contribution is an employer-sponsored retirement plan that allows employees to invest pre-tax funds in the capital market (e.g. in stocks). The interest on a defined contribution fund is tax-deferred until it is withdrawn during retirement. A 401(k) is, far and away, the most popular example of a defined contribution plan, followed by 403(b). Involvement in a company-sponsored deferred contribution retirement plan is completely optional. Employees choose whether or not to participate in a defined contribution plan. In the past, it was common for companies to match a percentage of employee contributions, though this is becoming increasingly rare.

Hybrid contribution plans: as the name implies, these are hybrids of the other two qualified contribution plan types. The most common hybrid contribution plan is called a cash balance plan. As with defined benefit plans, the company sponsoring the plan bears most of the investment risk for a hybrid plan. Hybrid retirement plans are most common among employers in the public sector. This type of plan aims to share the risk of retirement investment between the plan holder and the employer.

The IRS offers tax advantages for qualified retirement plans with the understanding that they will be used for retirement. If you need to withdraw any of your contributions before your set retirement age, you’ll usually face tax penalties, as much as 10%. Usually, that magic number is age 59 1/2, though there’s some variance. You also can’t leave your money in a qualified plan indefinitely; most plans require you to begin making withdrawals by age 70 1/2.

Another advantage of qualified plans is in how they are treated in regard to creditors. In bankruptcy proceedings, qualified plans are given preferential treatment in most states, and extra protection in other creditor situations.

Yet another type of retirement plan, an Individual Retirement Account (IRA), is very similar to a qualified plan in terms of both how it works and in its tax consequences. Technically, an IRA is not a qualified retirement plan because it is purchased on an individual basis, not offered through an employer. But because an IRA functions like a qualified plan, it is often lumped into the same category.

What is a Non-Qualified Retirement Plan?

Because they follow the guidelines of the Employee Retirement Income Security Act (ERISA), qualified plans have clear limitations. These limits apply to the number of employees who can enroll and how much money general employees can contribute.

Non-qualified retirement plans don’t fall under the ERISA, so they don’t have these limitations. Under a non-qualified plan, an employer can defer more money towards retirement than a qualified plan would allow, or give a top-performing and top-paid executive additional compensation above and beyond what general employees receive. Contributions to a non-qualified retirement plan are usually not tax-deductible for the employer and are taxable for the employee who receives them. Non-qualified retirement plans offer the advantages of long-term savings flexibility and tax-deferral.

Non-qualified retirement plans can be grouped into four general categories: Deferred-compensation plans, Executive bonus plans, Group carve-out plans, and Split-dollar life insurance plans.

Deferred-compensation plans: Deferred Compensation plans are designed to give executives supplemental retirement income. The executive defers a portion of their yearly income, which is usually annual bonus income. A similar model is a salary-continuation plan, in which the employer pays for the future retirement benefit for the executive. Both of these plans allow earnings to accrue tax-deferred, and the IRS then taxes the income at retirement as ordinary income.

Executive bonus plans: an executive bonus plan is the most simple type of non-qualified retirement plan. In an executive bonus plan, a company issues an employee a life insurance policy, and the employer pays the policy premiums. For tax purposes, the payments toward premiums are considered compensation, which makes them deductible for the employer and taxable for the executive. Occasionally, an employer will offset this tax expense by paying a higher bonus.

Group carve-out plans: like an executive bonus plan, a group carve-out plan is a retirement plan built around life insurance. In this case, an employer carves out an employee’s group life insurance plan in excess of $50,000, which is then replaced with an individual life insurance policy. Instead of paying the premium on the original group life insurance plan, the employer redirects those funds towards the individual policy, which belongs to the employee. The tax advantage here is that the employee is not responsible for the associated income on group life insurance in excess of $50,000.

Split-dollar life insurance plans: a split-dollar plan is another life insurance policy retirement arrangement. The goal of a split-dollar life insurance plan is to offer an executive a permanent life insurance policy. The employer takes out a life insurance policy on the executive. The employer usually pays the policy premium, and the employee pays the mortality cost. The two parties share ownership of the policy, hence the term “split-dollar.” When the policy pays out at the time of death, the employer receives a portion equal to the funds they originally contributed, and the executive’s beneficiaries receive the (much larger) remainder.

How are Qualified and Non-Qualified Retirement Plans Different?

Tax Deductibility

Contributions towards a qualified retirement plan are tax-deductible, while contributions towards a non-qualified plan are not tax deducible. However, the earnings on both qualified and non-qualified retirement plans are tax-deductible.

Investment Taxing

To pay towards a qualified retirement plan, you’ll invest pre-tax dollars, but for a non-qualified retirement plan, you’ll be investing after-tax dollars.

IRS Regulation

A qualified plan, but definition, must be approved under the requirements of IRS’ Internal Revenue Code Section 401(a). Non-qualified plans, of course, don’t need to follow these regulations.

Employee Eligibility

Qualified plans must include all employees, provided they meet certain basic requirements, such as one year of full-time employment. But non-qualified retirement plans can be offered to only the select employees a company chooses (usually top executives).

Contribution Limits

Qualified retirement plans have a cap on contributions set by the IRS- a maximum you’re allowed to pay into the plan each year. Under a non-qualified retirement plan, there’s no IRS contribution limit.

Accumulation Taxes

For both qualified and non-qualified plans, taxes on the accumulation of assets are deferred until the time of withdrawal.Early Withdrawal

For both qualified and non-qualified plans, penalties are assessed if the plan holder withdraws funds before their retirement age.Which is Better: Qualified or Non-qualified Retirement Plans?

Some of the perks offered to executive level-employees, like corner offices and company cars, are unequivocally better than what’s offered to the rank-and-file employees. But non-qualified retirement plans, which are usually offered by employers as a benefit for top executives, are not fundamentally better than qualified retirement plans. The best option for retirement savings will depend on your financial priorities.

The outstanding feature of non-qualified plans is their flexibility. Because they don’t adhere to the ERISA regulations, there’s no IRS-determined maximum annual contribution amount for a non-qualified plan. This is especially important for highly-compensated employees; the IRS has a whole set of tax restrictions that apply to individuals in this bracket. Highly-paid employees can contribute less of their salaries towards a qualified retirement plan. If your goal is to save enough to continue living an executive’s lifestyle after retirement, and you can afford to pay more taxes on your contributions, a non-qualified plan is ideal.

The outstanding feature of qualified plans is their tax advantages. Under a non-qualified plan, you can invest pre-tax dollars towards retirement, which saves you money on your annual income taxes. You also don’t have to pay taxes on your qualified plan’s investment gains until you begin disbursing the funds after retirement. You can only put so much towards a qualified plan, however. The IRS caps 401(k) contributions, for instance, at $18,500 per year, and Roth IRAs at $5,500 per year.

In most cases, the ideal situation for retirement savings is having a combination of both types of retirement plans: non-qualified and qualified. Having a mix of qualified and non-qualified retirement investments gives you the best balance and flexibility.